The financial sector’s adoption of an Environmental Risk Matrix is the subject of debate at Escolhas

On 24 March 2021, the Instituto Escolhas launched a new study to present the Environmental Risk Matrix: a decisive instrument designed to assist the financial sector in incorporating the environment and the climate in decision-making processes on financing electricity sector projects and other infrastructure projects.

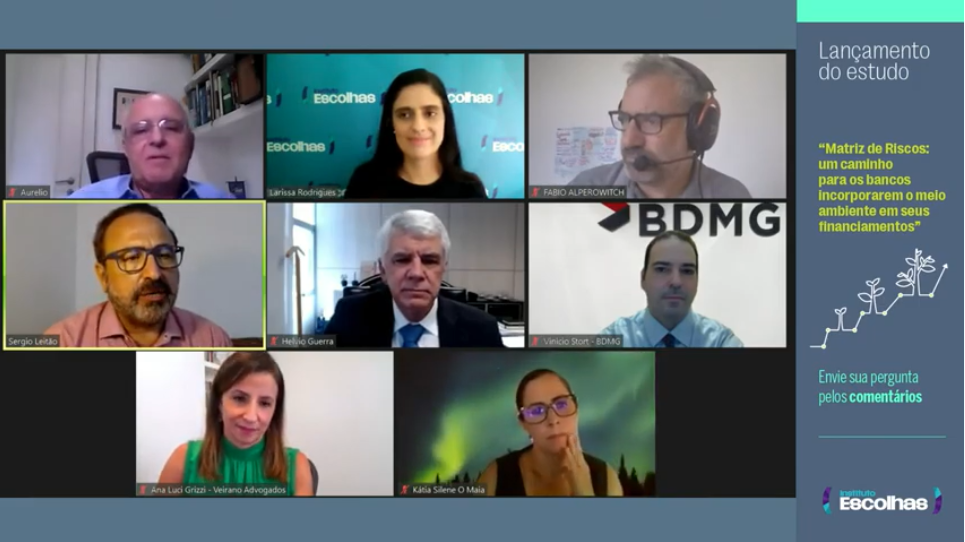

The study “Risk Matrix: a path for banks to incorporate the environment into their financing” confirms that the financial sector’s commitment to preserving the environment and fighting climate change can be reflected in financing decision-making processes that follow objective, standardized and transparent criteria. The launch took place during an online event, with the presence of important names from the financial and energy sector.

See the results:

The study analyzes three different types of power plants, showing that hydroelectric plants have the highest number of risks for the environment (46), followed by gas-fired power plants (34) and, finally, wind power plants (29), a reality that must be considered when financing such projects.

Regarding gas-fired power plants, the study highlights the risk of greenhouse gas emissions, demonstrating that financing new plants of this type only exacerbates the climate crisis and the carbon footprint of financers.

According to Larissa Rodrigues, Projects and Products Manager at the Instituto Escolhas, the Environmental Risk Matrix serves as a guide for analyzing future financing requests so that they can incorporate identified risks and align decision-making processes with a low-carbon economy.

“Environmental assessments of financing are still timid. Cases like the Belo Monte hydroelectric plant show that voluntary commitments are not enough to counter the risks of such projects or induce concrete changes towards a low-carbon economy. Without tools like the Risk Matrix, we will carry the mistakes of the past into the future”, says Larissa.

Aurelio Libanori, the researcher responsible for the study, explains that the environmental risks were defined according to their importance: a combination of magnitude, duration and reversibility of impacts.

Sergio Leitão, Executive Director of Escolhas, mediated the debates, explaining that the environment is always seen as an externality: “we are hoping this information will be used at the precise moment a decision is made on financing, allowing bankers and investors to take it into consideration before investing, avoiding later concerns”.

For Fabio Alperowitch, founder of FAMA Investimentos, a fundamental step is deconstructing the notion that environmental and climate issues are something new or fleeting. “Normally, environmental issues are a compliance issue, restricted to company inspections. In recent years, the environment has reached CEOs as a business opportunity”. Alperowitch highlights that “a framework or a matrix that identifies the risks of each energy source is essential for financial sector agents, signaling potential information sources for each previously ignored risk”.

Helvio Guerra, director of ANEEL – the Brazilian National Electric Energy Agency, suggested using the risk matrix for energy planning. According to Guerra, “a risk matrix which features objective elements for informing decision making processes on financing new electricity ventures could also assist in planning, regulating and formulating public policies. Indirectly, what the Instituto Escolhas is doing is seeking the best option for electricity production in our country.”

Kátia Silene de O. Maia, Sustainability Solutions Manager at the Banco do Brasil, reinforced that banks are interested in becoming increasingly sustainable, highlighting the matrix’s contribution not only to financing, but also to internal sustainability practices, ultimately reducing the impact of banking activities.

Vinicio Stort, Executive Director of the Development Bank of Minas Gerais – BDMG, said that it is essential for development banks to attune banking activities and development objectives, weighing up risks, returns and impacts. According to Stort, the matrix prepared by Escolhas makes a huge contribution. “This kind of work helps us harmonize these concepts. There is currently a lot of room for the economic recovery to include environmental and social aspects in a different way – it’s an opportunity”, says Stort.

Closing out the debates, Ana Luci Grizzi, lawyer and partner at Veirano Advogados, who collaborated on the draft resolution for the Central Bank of Brazil which Escolhas presented, stressed the importance of developing a specific regulation in order for the risk matrix to be incorporated by each sector. Properly channeling resources induces environmental compliance and ensures the availability of natural capital for economic activities. “Instead of thinking about the problems involved with this regulation, let’s think about the risk of not having it. The productive sectors need water, for example. Isn’t it safer to have a regulation that will ensure that companies use water in the right way, guaranteeing the availability of water for other businesses and for the continuity of the economy?”

To watch the presentation of the study and the entire discussion, access the recording of the event on Instituto Escolhas’ YouTube channel. To check out the full study, access our library

Related

Brazil attended COP-6 in Minamata without presenting an action plan to address mercury usage in mining

Study shows 2,274% increase in herbicide use for soybean production

Technical assistance is prevalent in legal regulations and public policies; however, a study indicates that it does not adequately reach rural producers

Study reveals Brazil applies pesticides and fertilizers inefficiently and unsustainably in soybean farming

Texto

Texto